Refinery Catalyst Market Volume Worth 3,696.90 Tons by 2035

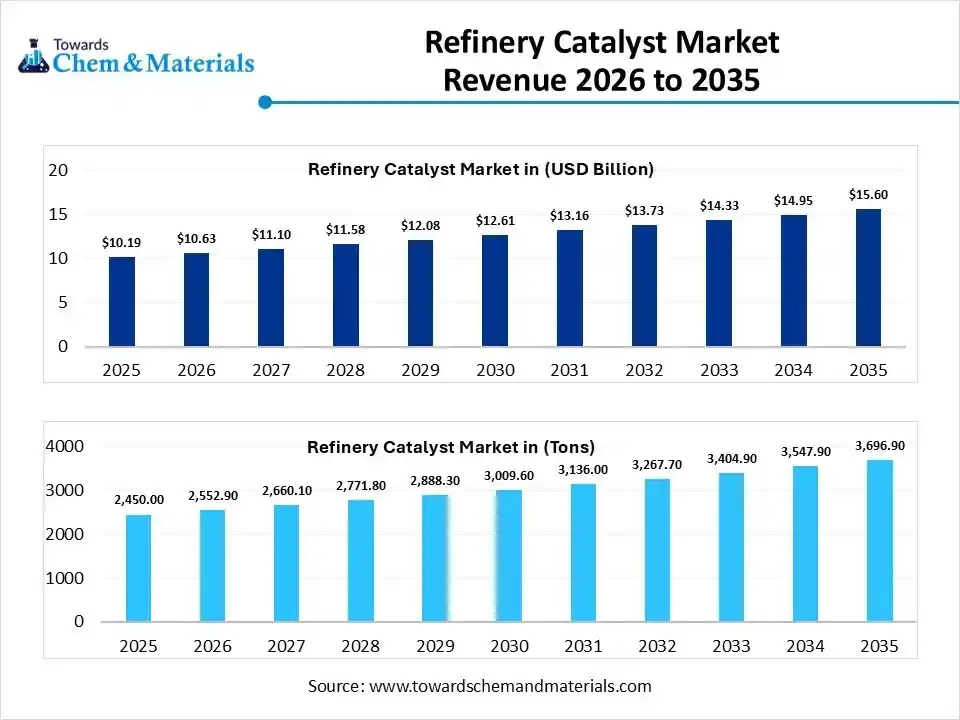

According to Towards Chemical and Materials, the global refinery catalyst market volume was valued at 2,450.00 tons in 2025 and is expected to be worth around 3,696.90 tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.20% over the forecast period from 2026 to 2035.

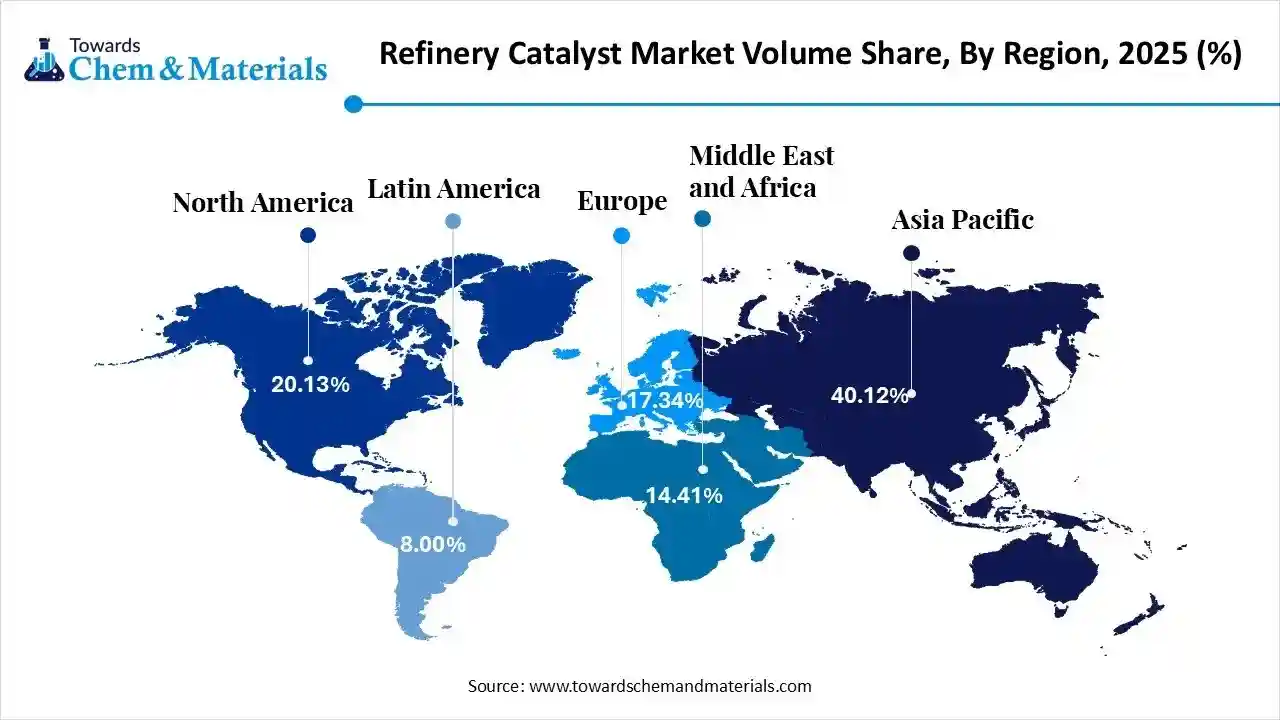

Ottawa, Jan. 20, 2026 (GLOBE NEWSWIRE) -- The global refinery catalyst market size was estimated at USD 10.19 billion in 2025 and is expected to increase from USD 10.63 billion in 2026 to USD 15.60 billion by 2035, growing at a CAGR of 4.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 2,450.00 tons in 2025 to 3,696.90 tons by 2035. growing at a CAGR of 4.20% from 2026 to 2035. Asia Pacific dominated the refinery catalyst market with the largest volume share of 40.12% in 2025. The market is driven by stringent environmental regulations, technological advancements, rising refining activities, and a focus on energy transition. A study published by Towards Chemical and Materials, a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6126

Refinery Catalysts: Enhancing Fuel Quality and Process Efficiency

A refinery catalyst is a crucial, tech-heavy agent used in the downstream petroleum industry to convert crude oil into valuable chemicals, like ultra-low sulfur diesel, gasoline, and petrochemical precursors. These catalysts enable refiners to stay flexible, profitable, and compliant while processing various crude types to meet demand for cleaner fuels.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Refinery Catalyst Market Report Highlights

- By region, Asia Pacific led the refinery catalyst market held the volume share of around 40.12% in 2025.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the development of new refineries.

- By material, the zeolites segment led the market with the largest volume share of 45.08% in 2025.

- By material, the chemical compounds segment is growing at the fastest CAGR in the market during the forecast period due to the growing energy demand.

- By application, the FCC catalyst segment led the market with the largest volume share of 42.21% in 2025.

- By application, the hydrotreating segment is expected to grow at the fastest CAGR in the market during the forecast period due to the enhanced efficiency of the refinery.

- By physical form, the powder segment accounted for the largest volume share of 48.33% in 2025.

- By physical form, the extrudates segment is expected to grow at the fastest CAGR in the market during the forecast period due to the optimal flow distribution.

- By end-use application, the transportation fuels segment dominated with the largest volume share of 50.11% in 2025.

- By end-use application, the petrochemical feedstocks segment is expected to grow at the fastest CAGR in the market during the forecast period due to the high production of petrochemical products.

Refinery Catalysts Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 10.63 Billion / 2,552.90 Tons |

| Revenue Forecast in 2035 | USD 15.60 Billion / 3,696.90 Tons |

| Growth Rate | CAGR 4.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material / Ingredient Type, By Application (Process Type), By Physical Form, By End-Use Application, By Region |

| Key companies profiled | Haldor Topsoe A/S, Honeywell UOP, Albemarle Corporation, W. R. Grace & Co., BASF SE, Axens SA, Johnson Matthey PLC, Clariant AG, Shell Catalyst & Technologies, Sinopec Catalyst Company, Evonik Industries AG, Chevron Corporation (ART), JGC Catalyst and Chemicals Ltd., Arkema S.A., ExxonMobil Corporation, Zeolyst International, Criterion Catalyst & Technologies, Nippon Ketjen Co., Ltd., Taiyo Koko Co., Ltd., Qingdao Huicheng Environmental Technology |

Private Industry Investments for Refinery Catalyst:

- Albemarle Corporation launched Ketjen in January 2023, a subsidiary focused on providing catalyst solutions for various industries, including refining.

- BASF SE introduced the Fourtiva™ fluidized catalytic cracking (FCC) catalyst in August 2024 to improve the production of high-octane gasoline components.

- Clariant AG is building a new catalyst production site in China to enhance its presence in the Asian market.

- Honeywell is acquiring Johnson Matthey's Catalyst Technologies business to expand its refining and petrochemical catalyst offerings.

-

W.R. Grace & Co. has invested in R&D for zeolite technology to create advanced FCC catalysts that optimize gasoline and distillate production.

What Are the Major Trends in the Refinery Catalyst Market?

- Green Catalysis: Industry focus on bio-based catalysts and multi-function catalysts that speed up refinery processes and reduce the number of refinery steps, lowering energy consumption.

- Sustainability and Clean Fuel Solutions: The increasing focus on reducing environmental impact and strict regulations is driving the transition to clean energy and sustainable processing technologies.

- Advanced Recycling and Regeneration: Refiners are increasingly implementing catalyst regeneration and recycling to recover value-added metals and minimize hazardous waste, supporting the circular economy principle.

- Processing Heavier Feedstocks: Refineries are shifting towards processing of metal-contaminated crude oils that driving the need for advanced catalysts to convert feedstock into valuable lighter products.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6126

Refinery Catalyst Market Dynamics

Driver

The refiners are pivoting towards Refinery-to-Chemicals (RTC) integration that is driving the demand for advanced Fluid Catalytic Cracking (FCC) and reforming catalysts designed to maximize the efficiency & yield of petrochemical feedstocks to transform fuel-grade molecules into high-tech materials to ensure long-term profitability.

Restraint

The rising adoption of Electric vehicles directly reduces long term demand for gasoline and diesel, that impacting the volatility of crude oil, raw material prices and high-capital investment. Overall, that create uncertainty for refiners that reduces capital expenditure on traditional catalyst-intensive fuel production processes.

Market Opportunity

What is the Most Significant Opportunity for Catalyst Manufacturers in 2026?

The transition to bio-refining and renewable diesel is the most significant opportunity in the refinery catalyst market. As the demand for Sustainable Aviation Fuel (SAF) and Hydrotreated Vegetable Oil (HVO) accelerates, there is a massive foundation for specialized catalysts capable of deoxygenating and isomerizing biological feedstocks that convert traditional refineries into green energy hubs.

Smart Catalysts: Transforming and Optimising Refineries with AI

AI and technological innovation serve as key tools for operational precision, shifting the refinery catalyst market towards high-technology products. By utilizing algorithms refiners design nanostructured catalysts that maximize yield by extending active lifecycles by anticipating deactivation. Overall, AI allows refiners to maintain profitability through automated, data-driven optimization of complex chemical reactions.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Refinery Catalyst Market Segmentation Insights

Material Insights

How Did the Zeolites Segment Dominate the Refinery Catalyst Market in 2025?

Zeolites dominate due to their crystalline structure, high thermal stability, and shape selectivity, vital for modern fuel production. They are essential in Fluid Catalytic Cracking (FCC), breaking heavy crude into gasoline and diesel, allowing maximized yields and minimizing unwanted byproducts, aiding environmental compliance, and optimizing overall efficiency of the refining process.

The chemical compounds segment is anticipated to grow fastest during the projected period. The growth is due to the global focus on desulfurization and fuel purification. They are essential for removing impurities, improving energy efficiency, and supporting sustainable refinery operations of cleaner-burning fuels, leading to technical innovation by advanced chemical formulations and market growth.

Application Insights

Which Application Segment Dominates the Refinery Catalyst Market in 2025?

The FCC catalyst segment dominated the market, a key engine for high-value hydrocarbon conversion within the modern refinery, converting heavy oils into transportation fuels and chemical feedstocks with high efficiency. Its ability to process diverse feeds while maintaining thermal stability ensures profitability and adaptability by operators in petrochemical integration.

The hydrotreating segment offers significant growth during the forecast period, driven by the need for cleaner fuels amid stricter environmental regulations. These catalysts have become essential for treating increasingly heavy and complex crude oil feedstocks. Hydrotreating is a key process for converting bio-based fats and oils and enabling renewable fuel production, while the need for desulfurization to meet air-quality standards makes it critical for future market growth.

Physical Form Insights

How did the Powder Form Segment Dominate the Refinery Catalyst Market?

The powder segment dominates the refinery catalyst market, mainly due to its role in fluid catalytic cracking (FCC) units. Its large surface area enables rapid chemical reactions and effective contact with heavy hydrocarbon feedstock. Designed for fluidization, powder catalysts circulate like liquids in reactors and regenerators. FCC units drive the volume in modern refineries, and the need for high-activity powders to boost gasoline and olefin yields ensures this segment's leadership.

The extrudates segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. because of their strong structure and optimized flow in fixed-bed reactors. Extrudates shaped as cylinders or trilobes offer more surface, lower pressure drops and are ideal for high-pressure processes like hydrotreating and hydrocracking. As refineries process heavier feedstocks and renewable fuels, demand for these durable, high-performance shapes exceeds traditional forms, making them essential for modern catalyst systems.

End-Use Application Insights

Why did the Transportation Fuels Segment Hold the Biggest Share in the Refinery Catalyst Market?

The transportation fuels segment dominates the market, accelerated by global refining operations and catalyst consumption. The massive demand for high-quality gasoline, diesel, and aviation turbine fuel need continuous supply of high-performance catalysts to optimize yield by ensuring the strict requirements of modern engines and global mobility. This ensures that transportation fuel production maintains its leadership in the area of catalytic technologies.

The petrochemical feedstocks segment is experiencing the fastest growth in the market during the projected period, driven by refineries' shift from traditional fuel production towards integrated chemical manufacturing, referred to as the crude-to-chemicals shift. As global demand for plastics, polymers, and synthetic materials rises, refineries are deploying specialized catalytic systems that ensure the production of petrochemical precursors for next-generation catalytic technologies.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6126

Regional Insights

How did the Asia Pacific hold the Largest Share of the Refinery Catalyst Market?

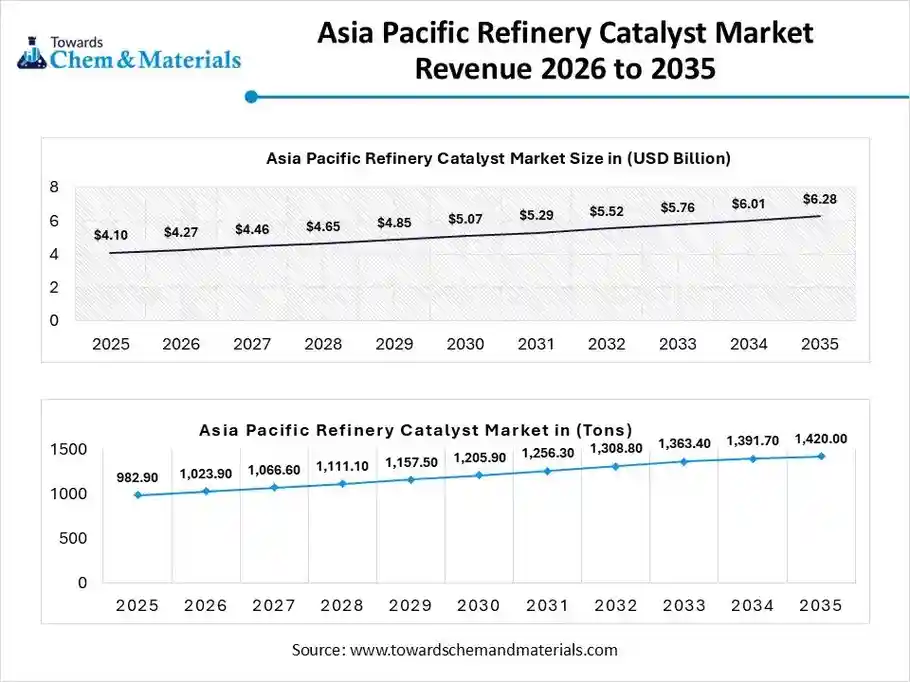

The Asia Pacific refinery catalyst market size was valued at USD 4.10 billion in 2025 and is expected to be worth around USD 6.28 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.37% over the forecast period from 2026 to 2035.The Asia Pacific refinery catalyst market volume was estimated at 982.9 tons in 2025 and is projected to reach 1,420.00 tons by 2035, growing at a CAGR of 4.17% from 2026 to 2035. Asia Pacific dominated the market with approximately 40.12% volume share in 2025.

The Asia-Pacific region leads the global market due to its extensive downstream infrastructure, complex integrated complexes, and strategies like Crude-to-Chemicals, along with clean-fuel mandates. It drives high-performance catalyst demand, necessitating advanced solutions for processing diverse feedstocks while meeting strict environmental standards.

China Refinery Catalyst Market Trends

China's market is experiencing moderate growth as the country continues to operate the largest refining capacity in Asia to meet domestic and export fuel demand. Stricter fuel quality and environmental regulations are driving demand for advanced catalysts used in hydrotreating, hydrocracking, and sulfur removal processes.

Why Refinery Catalyst Market Growing Rapidly in the Middle East & Africa?

The Middle East & Africa market is the fastest growing, shifting toward domestic value addition and economic diversification. By shifting from raw crude exporters to a global hub for developing integrated complexes needing large volumes of catalysts, boosted by advanced hydro processing technologies to meet environmental standards, the region is a global driver for catalyst demand and downstream innovation.

The UAE Refinery Catalyst Market Trends

China's market is experiencing moderate growth as the country continues to operate the largest refining capacity in Asia to meet domestic and export fuel demand. Stricter fuel quality and environmental regulations are driving demand for advanced catalysts used in hydrotreating, hydrocracking, and sulphur removal processes.

More Insights in Towards Chemical and Materials:

- Sustainable Catalysts Market Size to Surpass USD 16.54 Bn by 2035

- Nano catalysts Market Size to Surpass USD 7.30 Billion by 2034

- Polyethylene Terephthalate Catalyst Market Size to Hit USD 1,321.75 Mn by 2034

- Fertilizer Catalysts Market Size to Exceed USD 4.75 Billion by 2034

- Catalyst Market Size to Reach USD 34.18 billion in 2025

- High-Performance Catalyst Market Size Boosts USD 30.02 Bn By 2034

- Organic Fertilizers Market Size to Hit USD 23.35 Billion by 2035

- Green Fertilizer Market Size to Exceed USD 7.88 Billion by 2035

- Smart Fertilizers Market Size to Reach USD 6.56 Billion by 2035

- Liquid Fertilizers Market Size to Worth USD 4.93 Billion by 2035

- Agriculture Fertilizers Market Size to Surpass USD 332.79 Billion by 2035

- Biofertilizer Market Size To Hit USD 11.08 Billion by 2035

- Europe Fertilizers Market Size to Hit USD 95.30 Billion by 2035

- U.S. Fertilizers Market Size to Hit USD 48.94 Bn by 2035

- Asia Pacific Nitrogenous Fertilizer Market Size to Worth USD 157.57 Bn by 2034

- Middle East Phosphate Fertilizer Market Size to Reach USD 2.74 Bn by 2034

- Sulfur Fertilizer Market Size to Hit USD 8.02 Billion by 2034

- Fertilizer Catalysts Market Size to Exceed USD 4.75 Billion by 2034

- Controlled Release Fertilizers Market Size to Hit USD 5.36 Bn by 2035

- Asia Pacific Fertilizers Market Size to Reach USD 313.44 Bn by 2034

- U.S. Nitrogenous Fertilizer Market Size to Surpass USD 26.29 Bn by 2034

- Nitrogenous Fertilizer Market Size to Reach USD 224.55 Bn by 2034

- Specialty Fertilizers Market Size to Surpass USD 86.23 Bn by 2035

- Fertilizers Market Size to Hit USD 380.16 Billion by 2035

-

Phosphate Fertilizers Market Size to Hit 124.97 Bn by 2034

Top Companies in the Refinery Catalyst Market & Their Offerings:

Tier 1:

- Haldor Topsoe A/S: Focuses on high-performance hydroprocessing and hydrotreating catalysts for ultra-low sulfur diesel production.

- Albemarle Corporation: Specializes in FCC and hydroprocessing solutions to optimize clean fuel yields through its subsidiary, Ketjen.

- Honeywell UOP: Provides a diverse range of Unity™ hydrocracking and selective hydrotreating catalysts for impurity removal.

- W.R. Grace & Co.: Leads in FCC catalysts and additives while offering hydroprocessing solutions via its ART joint venture.

- BASF SE: Supplies FCC catalysts designed to maximize refinery profitability and mitigate the effects of heavy metal contaminants.

- Axens SA: Delivers a full suite of catalysts for hydrotreating, reforming, and isomerization to produce high-quality transport fuels.

- Shell Catalyst & Technologies: Offers high-activity hydroprocessing and residue upgrading catalysts backed by extensive owner-operator experience.

- Johnson Matthey PLC: Focuses on specialized catalysts for hydrogen production, gas purification, and high-value chemical conversion.

Tier 2:

- Clariant AG

- Sinopec Catalyst Company

- Evonik Industries AG

- Chevron Corporation (ART)

- JGC Catalyst and Chemicals Ltd.

- Arkema S.A.

- ExxonMobil Corporation

- Zeolyst International

- Criterion Catalyst & Technologies

- Nippon Ketjen Co., Ltd.

- Taiyo Koko Co., Ltd.

- Qingdao Huicheng Environmental Technology

What is Going Around the Global Refinery Catalyst Industry

- In November 2025, Dangote Refinery announced a strategic partnership with US-based Honeywell to Expand refinery. This collaboration focuses on improving operational efficiency and strengthen is global position as a single refining complex.

- In October 2025, Aramco, Honeywell, and Kaust signed a joint development agreement to co-develop technology for the advancement of crude-to-chemicals (CTC) technology. This partnership focuses on scaling up the CTC process and reducing operational cost that helping to advance economic diversification.

Refinery Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Refinery Catalyst Market

By Material / Ingredient Type

- Zeolites

- Metals

- Chemical Compounds

By Application (Process Type)

- Fluid Catalytic Cracking (FCC)

- Hydrotreating

- Hydrocracking

- Catalytic Reforming

- Alkylation & Isomerization

By Physical Form

- Powder

- Spheres / Beads

- Extrudates (Cylindrical pellets)

- Granular

By End-Use Application

- Transportation Fuels

- Petrochemical Feedstocks

- Marine & Industrial Fuels

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6126

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.